What we do

A Comprehensive Assessment Of Your Needs With A Tailored Strategy

This is our most in-depth analysis of your and your family’s current and future needs. By developing a detailed understanding of your personal, financial, and legal circumstances, we identify areas where future complications or losses may arise. This proactive approach enables you to make informed decisions today—minimising risk, safeguarding assets, and preserving your legacy exactly as you intend.

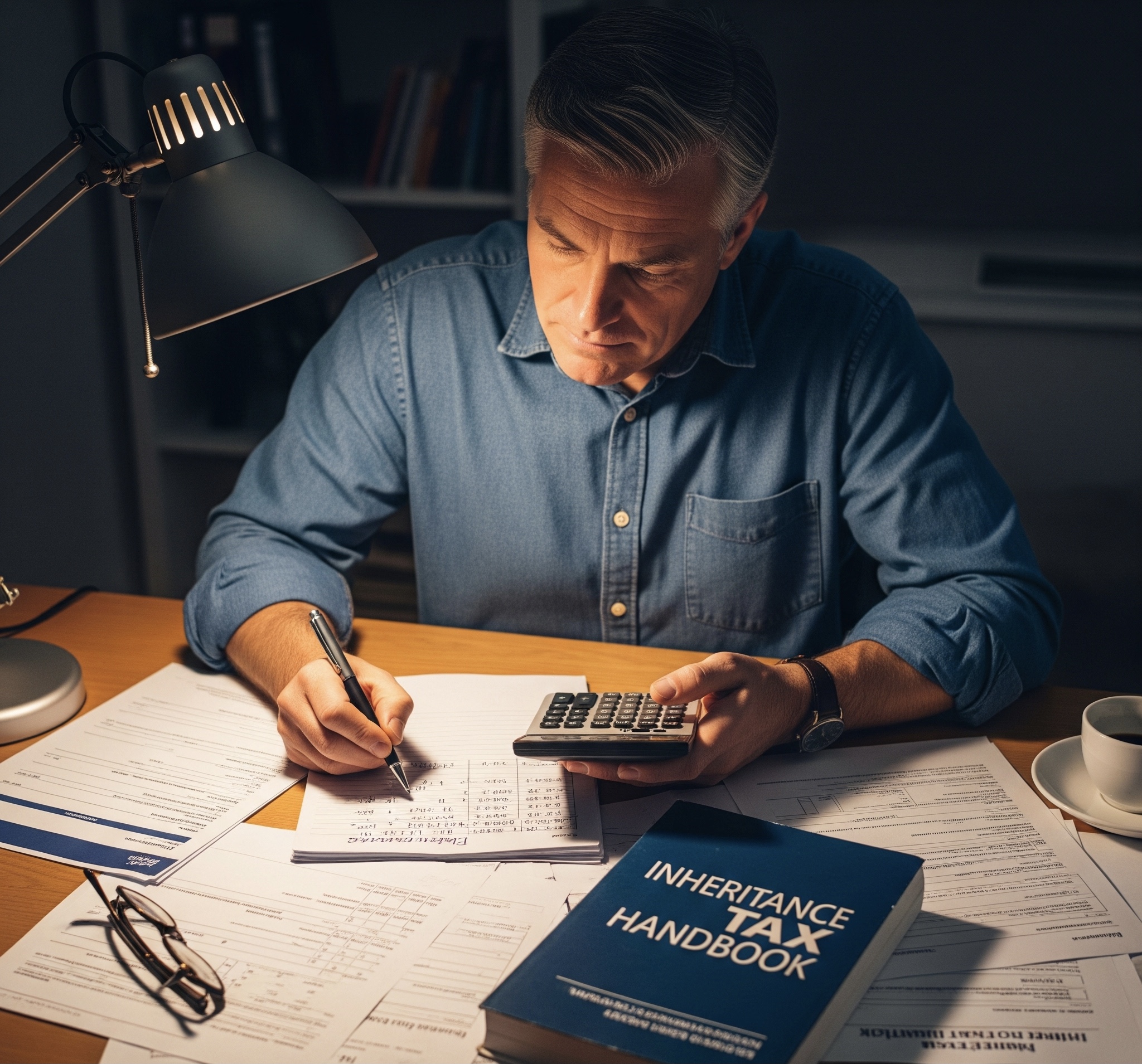

A Specific Focus To Your Inheritance Tax Position

If you are concerned about how inheritance tax could affect your estate, it is essential to consider this as part of your wider financial planning. Understanding the potential implications enables you to take proactive measures to reduce, or possibly eliminate the liability, so preserving more of your estate.

Inheritance Disputes

The Rise Of Family Feuds To A Deceaseds Estate

There has been a notable increase in family disputes concerning the division of assets following a death. These challenges, known as contentious probate, can cause lasting damage to family relationships and lead to significant legal costs. Many of these disputes can be avoided through clear and well-documented estate planning instructions.

Contact Us Or Try The Claim Checker Free.

Note: Link opens in another tab linked to IRDN Law

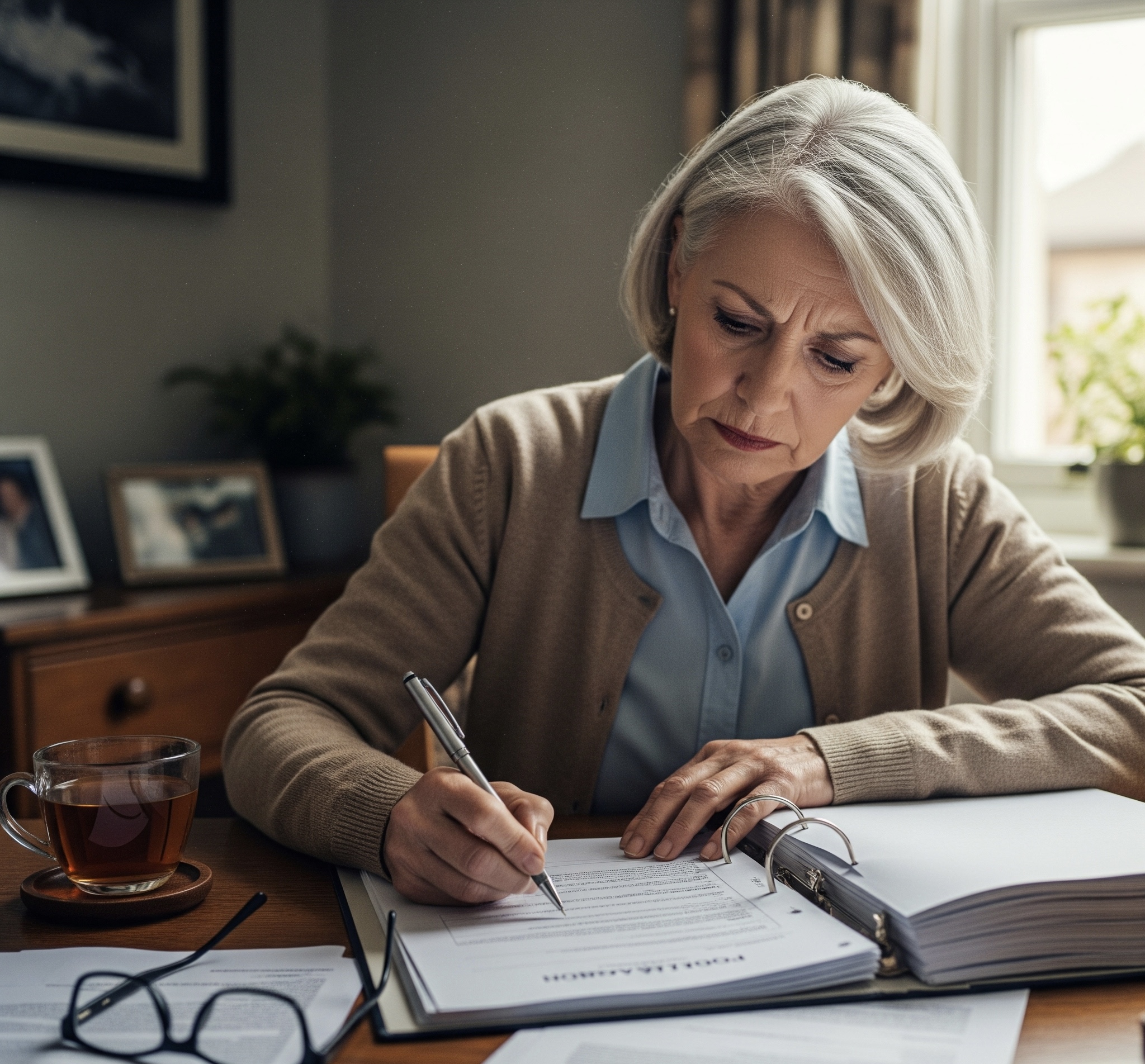

The Probate Process

The Process To Legally Access a Deceaseds Estate

The probate process is a legal procedure that many people will encounter at some point in their lives. It can be complex and, for some, a daunting and time-consuming experience involving detailed fact-finding and reporting. While much depends on individual circumstances, the process can be made significantly smoother through careful preparation and forward planning.

Care Fees

A Real Concern For Many Families- Know Your Options

The issue of funding care later in life has been debated for many years, with successive governments struggling to provide a lasting solution. This ongoing uncertainty often leaves families facing difficult decisions at an already challenging time. Gaining a clear understanding of the options available can help families prepare in advance and make informed choices about a loved one’s future care.

The care assessment process can be complex and, at times, overwhelming, with multiple procedures to navigate. However, it is important to remember that the cost of care does not always have to fall solely on the family. Understanding the assessment criteria and available funding options can make a significant difference to both the level of support received and the financial impact on the people involved.

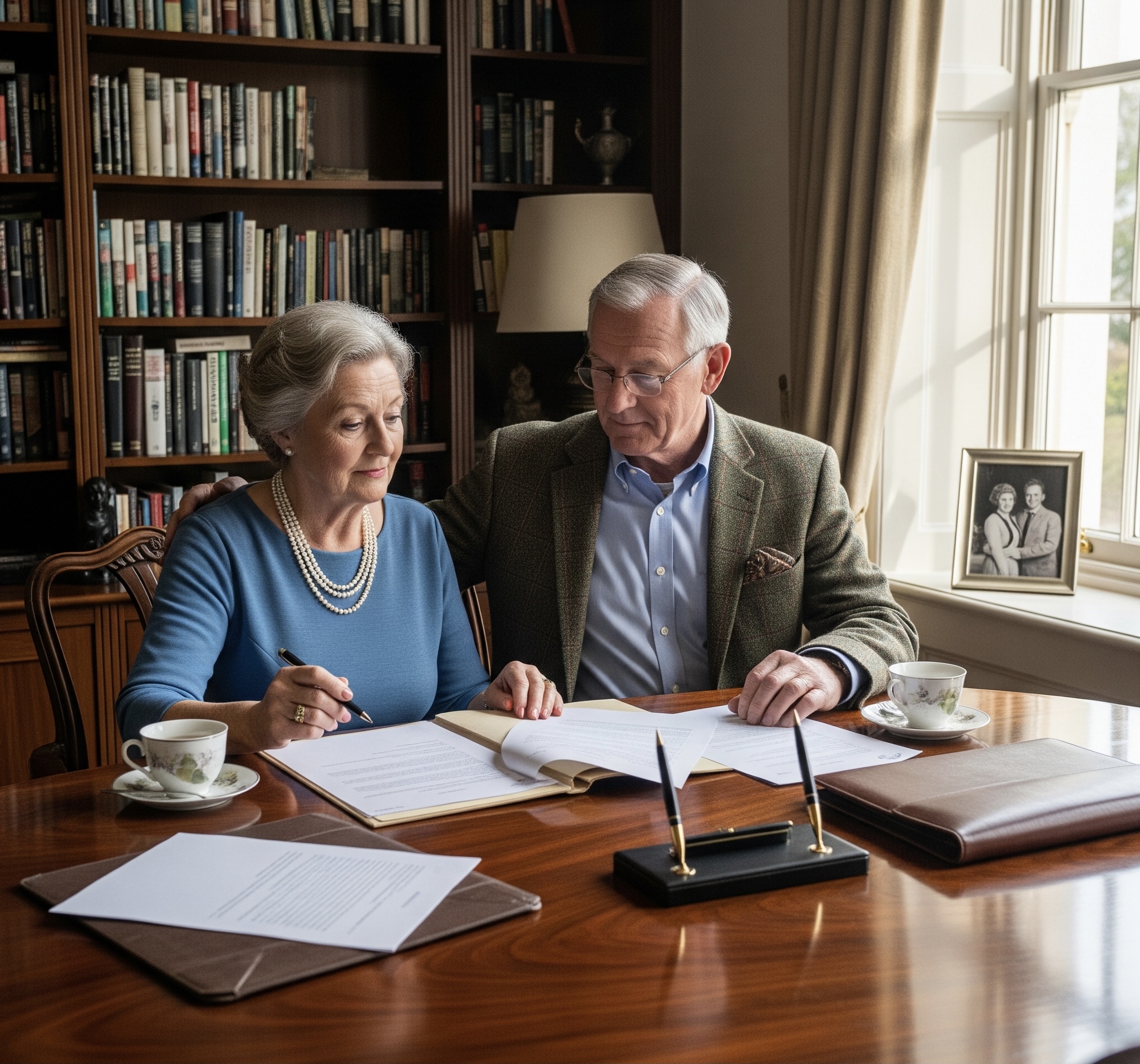

Writing Your Last Will

Your Will Is Very Important- But Is It Enough ?

It is often said that your Will is the most important document you will ever write — and it is important. However, many people overlook whether their Will truly reflects their wishes and provides sufficient clarity. Traditional legal language can sometimes make Wills difficult to interpret, and poorly drafted documents can lead to confusion or disputes.

Unclear or outdated Wills can even delay the issuing of a Grant of Probate, preventing the timely distribution of assets of the estate. As part of your wider estate planning, it is essential to ensure your Will is clearly written, up to date, and supported by additional documentation where appropriate to provide complete clarity over your intentions.

What Are Trusts

You May Have Heard Of Trusts- Do You Need One ?

Trusts are legal arrangements that allow one party to hold property for the benefit of another. They are not exclusive to the extremely wealthy; many people use them for various financial and estate planning needs.

In simple terms a trust is created when one or more people entrusts others with property for the benefit of others. There are a number of reasons for wanting to create a trust and there are different trust types to meet a desired objective. Trusts can be created in a lifetime or through a persons Will when they die.

Lasting Power Of Attorney

Would You Prefer For A Stranger To Make Choices And Decisions for You ?

A Lasting Power of Attorney is essentially a legal document that once registered with the Office of The Public Guardian grants a people of your choosing to manage your affairs if you lose the capacity to do so for yourself.

There are two types; Firstly, Property and Affairs which provides for Financially related matters and the second provides for Health and Welfare.

When an individual loses capacity and cannot make decisions for themselves the Court of Protection may intervene and appoint a stranger to take control with a deputyship order. This process is expensive and can take several months to implement.

What Are Living Wills

A Living Will puts you in control

A Living Will, also known as an Advance Directive, allows you to set out your preferences for medical treatment in the event that you are unable to communicate your wishes in the future. It ensures that your voice is heard and your choices are respected, even if you lose capacity to make decisions for yourself.

Having a Living Will in place provides clarity for healthcare professionals and reassurance for your loved ones, helping to avoid uncertainty or conflict at a difficult time. It forms an important part of planning ahead and ensuring that your personal values and wishes are honoured.

Pension Options.

Pensions Can Be A Useful Estate Planning Tool

The primary purpose of a pension is to provide an income in retirement, but modern pension arrangements offer far greater flexibility than in the past. You may choose to defer taking an income, draw funds as and when required, or structure withdrawals to suit your personal circumstances.

Pensions can also play a valuable role in managing income tax and forming part of a broader inheritance tax planning strategy. With the right approach, they can help preserve wealth and provide for loved ones in a tax-efficient manner.

Pension advice must only be provided by a regulated financial adviser with the appropriate qualifications and authorisation. We work closely with our regulated partners who can assist you in exploring your options and identifying the most suitable solutions for your individual needs.

Business Succession

When Its Time To Pass On Your Business Let Us Help

As a business owner, planning for the future is just as important as managing the present. When the time comes to pass on the baton, it’s essential to consider who will take over the running of your business. While there are clear benefits to keeping a family business within the family, this may not always be the best or only option.

We can help you explore the choices available and put a well-structured succession plan in place — ensuring a smooth transition, protecting the value of your business, and providing peace of mind for you and your loved ones.